Let's Talk

Bank and Credit Union,Automation Solutions

modernized Automation

Banking Solutions

ATMs

iTMs

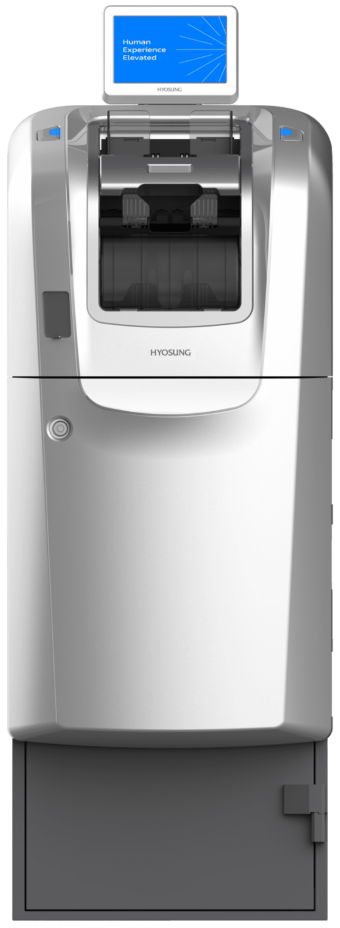

TCRs

Teller Cash Recyclers streamline the cash management process by automatically sorting, storing and reusing currency to boost productivity, eliminating the need to manage a manual cash drawer.

Connect Digital Desk

Mobile Security Access Control

can integrate with branch equipment and allows employees fast, convenient access without the hassle of managing traditional dual control processes.

Process Automation Guidance

is available from our team of bankers with vast experience setting up parameters, balancing, change management training, audit procedures and more.

Bank Equipment Models

Collectively, these automation solutions empower our clients to stay ahead of the curve and deliver a modern, efficient banking experience that today’s consumers have come to expect.

- 5L - Cash Dispense Lobby ATM

- 5T - Through-the-Wall ATM

- 7D - Full Function ATM (Thru-Wall or Drive-Up)

- 7I - Full Function Drive-Up ATM

- 8D - Recycling ATM

- 8I - Island Recycling ATM

- 8LR - Assisted Self Service Banking

- Add core integration with video banking to your iTM

Our Goal is to Help You

- Make your branch more efficient

- Optimize your staffing model

- Enhance your customer experience

- Implement technology for automation

- Streamline balancing and operational processes

- Cajera CR-U (MS500S)

- Cajera CR-H (MS500)

Secure Service

- Support in-branch and remote customers

- Paperless System

- Remote Banker

- Biometric Authentication

- Flexible Modularity

Ensuring success

Creating a Successful Technology Implementation Strategy

Prioritizing Your Investment in Technology

Select the Technology that Meets Your Goals

Determine the Best Time to Implement

secure & centralize management

Bank Equipment Access Control

Overall benefits derived from the secure access include:

- Affordable all-in-one solution

- Centralized user and profile management

- Real-Time visibility

- Easy-to-use interface

- Interactive floor plans

Click to learn more!