Dynamic Statements

Turning Digital Documents into

meaningful and personalized tools.

Consumers expect more frequent, meaningful, and personalized communications from their institution. With interactive, Dynamic Statements, you have the ability to bring their onboarding experience to life and deepen the relationship by making it personal.

A statement should drive digital engagement and provide the primary information and clear pathway for your customer to learn and buy more. Our interactive statements do just that!

The Ultimate Brand Game Changer

A Dynamic Document is an immutable, legal statement-of-record that replaces the PDF and HTML static statement transforming it into an engaging educational tool for your:

- Checking

- Savings

- Money Market Savings

- Certificate of Deposits

- Credit Card

- Mortgage Loans

- Personal Loans

- Wealth / Investment

- Business Accounts

- Account Analysis

- The list goes on

The Next Generation

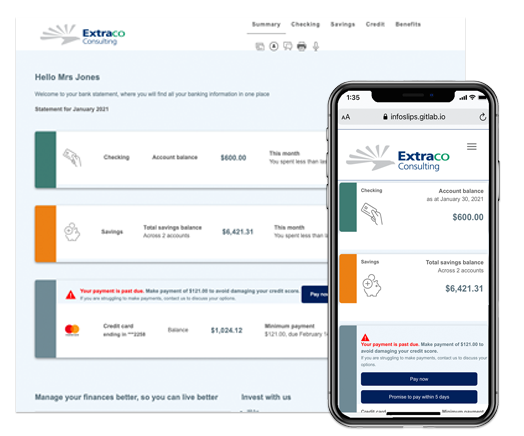

We all know that traditional eStatements are simply an image of the printed paper statement. Dynamic Statements are different.

Most people are mobile and view their eStatements through their mobile device.Dynamic Statements have the ability to consolidate the entire financial relationship into one notification vehicle.

The tool can be used to transform spending and savings behaviors through digital education, allowing the customers to incorporate savings discipline into their life. It encourages your customer to expand and explore their financial insights that could lead to upgrades (upsells) or new products and services (cross sells) to better support their growing or changing lifestyle.

SEE IT IN ACTIONCustomer Onboarding

We all know the expense related to acquisition of a new customer compared to retaining an existing customer. That’s why building your digital assets into something more meaningful is vital to fueling long-term relationships for retention and growth. Customer marketing that targets post-purchase with the goal of increasing retention and loyalty is made easier when using your institutions core elements such as an eStatement to be more of a Personalized “Onboarding” Statement. And, taking a holistic approach to the onboarding process can provide additional revenue potential in cross-selling, upselling, and incentivizing profitable behaviors.

Value in Action

What clients really like about the Dynamic approach to eStatements is their ability to include augmented video that is personalized to the customer. Because the video is augmented reality, it allows your customer to change the outcome based on the behaviors they are willing to change or take.

Deepening the Relationship

To deepen the client engagement, dynamic statements will provide customers insights and analytics, while allowing them to measure their own return on investment. The onboarding process becomes intuitive, fun, and purposeful, increasing retention and profitability.

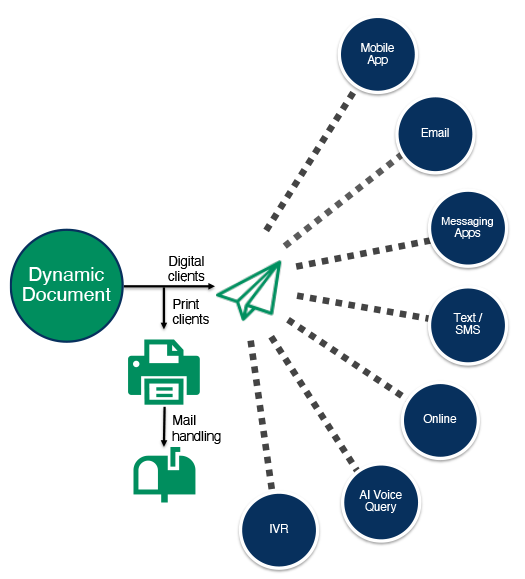

Compose Once. Deliver Anywhere.

Omni-Channel Engagement

This Dynamic Document revolutionalizes communication and delivery of the traditional statement. It creates an omni-channel legally compliant satement-of-record for engagement that is adaptable to any device and can be shared in any form of reference you prefer.

- Mobile App

- Text or SMS

- Messaging Apps

- Online Banking

- AI Voice Query

- IVR

- Print & Mail

You are able to seamlessly integrate into payment gateways and dynamically change template assets at composition time such as language, text, video, imagery, and brand.